In a nutshell, negative gearing means that you are making a loss out of your property investment. This happens when the interest repayments and expenses on your investment are greater than the rental return.

Negative gearing in Australia has attracted a lot of media attention in recent years, especially in the lead-up to the federal election that was held on May 2019.

If you have a negative gearing investment property in Australia, you can reduce your tax bill significantly. For this reason, negative gearing has been called both a valuable tool for investors, as well as an unnecessary tax concession that has made housing unaffordable for many Australians.

What is negative gearing?

The term ‘gearing’ refers to borrowing money to buy an asset. Within a real estate context, it means taking out a home loan to buy a property

What is negative gearing according to the ATO:

“A rental property is negatively geared when it is purchased with the assistance of borrowed funds and the net rental income, after deducting other expenses, is less than the interest on the borrowings.”

This means that you could take out a home loan to buy an investment property, cover a range of maintenance and operational costs, and at the end of the financial year you may discover that the annual rental income generated was less than the expenses you incurred.

This is not a good result for your investment, but you can benefit from this loss by offsetting it against the income you earn from other sources.

As a consequence, you will be effectively earning less overall income, which will result in you having less tax to pay at the end of the financial year.

What can be claimed as a tax deduction from a property investment?

Rules and regulations around what is considered a legitimate expense for a real estate investment can sometimes be difficult to work out. It is important that you do your homework and fully understand the system to avoid being audited by the ATO for questionable claims.

It is recommended that you get professional advice to avoid the common mistakes that land many property investors into trouble.

In simple terms, the costs of owning an investment property can be divided into two main categories:

- Non-cash costs such as any depreciation

- Cash costs, which are normally expenses related to running and maintaining your property investment, and can include:

- Property management fees

- Council rates and body corporate fees

- Advertising for tenants

- The costs to repair something within your property

- General maintenance (such as gardening)

- Pest control

- Water, electricity, gas and other utility bills that you are paying – not the tenant.

- Insurance, including Lenders mortgage insurance

- Interest on your home loan repayments

- Bank or solicitor fees for keeping title documents safe

- Taxation or accounting advice relating to the property

- Legal expenses to evict a tenant

- Doing credit checks or hiring a debt collector to collect rent arrears

- Quantity surveyor for assessing depreciation claims

Items which cannot be claimed include:

- Those relating to the purchase or sale of the investment property

- Utility bills which are paid by the tenant

- Borrowing costs if you have borrowed against the equity in the investment property for private use

- Costs relating to your personal use of the rental property

Depreciation of assets

There were some changes introduced in 2017, which resulted in Australian property investors no longer being able to claim depreciation of assets that were at the property at the time of purchase (such as carpets, blinds, air-conditioning units or kitchen equipment)

However, you can claim depreciation on new features that you might add to a property. For example, if you change the carpets or buy a new heat pump. These items have value associated with them that will depreciate with time.

In order to make taxation claims, you need to keep official records including receipts and bank statements, as well as an accurate depreciation schedule and capital works schedule.

Calculating depreciation is a complex matter, so it is recommended that the depreciation schedule is done by a quantity surveyor.

What are the pros and cons of negative gearing?

Pros

Tax savings:

This is the biggest benefit of a negative gearing investment property. You can offset your property investment loss against income made from other sources during the same financial year. This will result in a reduced taxable income, meaning that you will have less tax to pay that year.

Open up investment opportunities:

Property investors looking to buy positive cash flow properties have a more restricted pool of properties to choose from. These properties can be expensive and hard to find, and are often limited to areas where the rental income exceeds expenses. Those who are also willing to invest in a negative gearing investment property will have a wider range of options to choose from.

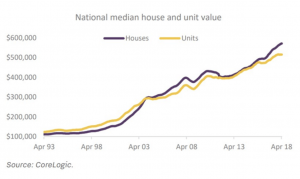

Capital growth

One of the biggest attractions of a negative gearing investment property is that you can benefit from long term capital growth. This type of investing can help someone afford a property with the potential to grow in value over a longer period of time, even if you cannot generate a high rental income in the short term.

Cons

Cash flow risks

If you own a negative gearing investment property, you are regularly paying more money than you are getting. This means that you are paying costs out of your own pocket, rather than having a self-sufficient investment. Interest rate increases can have a big impact on your cash flow.

Capital growth risks

The main risk of owning a property that costs you money, is that you could find yourself in a situation where you need to sell it before you have benefited from any capital growth. A worst-case scenario is that you can no longer afford to keep putting money into the negative gearing property and are forced to sell it for less than what you originally bought it for.

Borrowing power reductions

A negative gearing investment property can negatively impact your borrowing power, which can limit how many properties you have in your investment portfolio.

If you want to discuss how negative gearing might affect your borrowing power, you can take advantage of the free consultation with a licensed home loan professional that is available via our website.

What place does negative gearing have in the Australian market?

Negative gearing in Australia is a complicated subject which has been a hot topic for many years. You will find passionate supporters as well as equally strong opposition. Negative gearing is either making or breaking the real estate housing market, depending on who you talk to.

One of the main arguments against negative gearing in Australia is that it encourages property investment and reduces housing supply for regular home buyers. The theory is that as a result property prices increase making home ownership unattainable for many, although this hasn’t been definitively proven.

Some opposition call negative gearing a ‘tax evasion strategy’ that encourages risky investment behavior and only benefits the rich.

The arguments in favor of negative gearing usually focus on the apparent benefits it brings to the often called “mum and dad” investors, who are able to get into the world of property investment on moderate incomes.

They also highlight that negative gearing encourages investing in property and fuels the building industry. They claim that removing it could raise rents as the lack of tax benefits would raise investors’ costs, and these will eventually be passed on to the tenants.

What were Labor’s proposed negative gearing changes?

During the May 2019 election campaign, the Labor Party promised some negative gearing changes if elected into power.

These changes included limiting negative gearing on new houses and to halve the capital gains tax discount to 25% for all assets from 1 January 2020. Investments made before this date would not have been affected by these changes, and would have been able to continue operating under the existing rules.

Labor argued these negative gearing changes would improve house affordability as well as boost housing supply and jobs.

How does negative gearing work? An example:

We have put together a fictional example to illustrate the numbers for negative gearing:

- John buys an investment property worth $500,000

- He has a deposit of $100,000

- He gets a loan for $400,000 from the bank

- The weekly rent he collects amounts to $18,000 per year

- John has an interest only mortgage, with a rate of 4.2%. The yearly interest charges are $16,800 per year

- His expenses for the financial year are $1,000 on maintenance, $1,500 council fees, $1000 on property management fees and $1,000 on insurance.

- His claimable costs for the year are $21,300 (this is made out of his interest payment plus expenses). This is $3,300 more than he collects in rent.

This means that John has a negative gearing investment property and he can deduct his loss of $3,300 from his taxable income made from other sources.

How do I calculate my negative gearing loss?

If you would like to work out your negative gearing loss, you can use a negative gearing calculator online, or you can do it manually by following these steps:

- Calculate your property’s yearly rental income. You will need to multiply the weekly rent by 52.

- Calculate your property expenses. This can include mortgage interest payments maintenance costs, repairs, advertising costs, property management fees, and so on.

- Deduct depreciation if applicable. Remember this can only be claimed if these are new features that you have personally added to the property (such as light fittings). Depreciation cannot be claimed on items which were already in the property at the time of the purchase. It is recommended that you enlist the help of an accountant to help you set up a depreciation schedule.

- Calculate your total costs, which will be total expenses + depreciation

- Deduct total costs from your yearly rental income.

- This figure will be your negative gearing loss.

You can also visit our website to access a range of calculators such as budget planners, compound interest calculators and more.

Is negative gearing right for me?

Even if you understand what is negative gearing and its implications, you should ask yourself some questions before investing in a negatively geared property:

- What would happen if I can’t find a tenant?

- Can I afford having a vacant property for an extended period?

- How will I cope with a cash flow shortage?

- What would happen if my personal situation changes? Would I still be able to maintain my investment property if I lose my job or start a family?

- Could I still afford to live up to my current living standards on the money I make from other sources knowing that I would be losing money on this property investment?

- What would happen if the property market takes a downturn and I was unable to achieve the expected capital gain?

- Will the tax benefit I might make from negative gearing outweigh the cost of losing money on this investment?

- Would I still be able to afford the home loan repayments if interest rates were to rise?

- What would happen if I was unable to make loan repayments?

- What would happen if tax laws change and negative gearing is no longer claimable against other types of income?

- How long will it take before the investment is positively geared?

- Should I consider investing in a SMSF, the stock market or other managed funds? Will this be more suitable for my current situation?

Ready to take the first step into your real estate investing journey? Or maybe you are wanting to add to your existing portfolio? Get started with a free home loan report with Property Market Investors.

We can also help you get matched with personalised investment properties. Simply answer a few questions and we can send you opportunities tailored to your needs.