Property investing is one of the most popular types of investment in Australia, In order to start investing in property you first need to determine your property investing strategy. Property is tangible, and many people are attracted to the idea of putting their money into something they can touch and feel. This type of investment is often perceived as less volatile and easier to understand than other investments such cash funds, bonds, or the stock market.

Perhaps the most attractive feature of investing in property is the ability to benefit from long-term capital growth. Property can deliver good returns over time if the value increases, and there is also the appeal of receiving rental income as a way to fund the investment.

The best property investment strategies start with a good plan. It pays to do your homework and spend some time putting together a thorough strategy to suit your individual circumstances.

Step 1: Planning

Educate yourself

Aim to become a property market expert. Read real estate related news, browse through property blogs, and join online forums. Stay up-to-date with trends, tax reforms, and legislation changes.

Follow the property market in your neighbourhood

Check sales results regularly so you can recognise pricing trends in your area, this will form your investment finance strategy. Attend auctions to get a feel for the market.

Get in touch with professionals

Source reputable industry professionals to gain insight into their field of expertise. The people you should be reaching out to include:

- Real estate agents

- Property managers

- Mortgage brokers

- Financial planners

- Accountants

If you want to get your investment property planning stage underway but don’t know where to start, have a browse through the resources at Property Market Investor. We are a one-stop solution for all your property investment strategy planning needs.

By partnering with some of Australia’s leading property experts across many disciplines, we have created Australia’s leading community and portal for property investors.

Visit our website to access local market insights, research, trusted advice, and handy tools such as budget planners and property loan calculators.

Step 2: Do the numbers

Shop around for a competitive property loan

The property loan market in Australia is highly competitive, so it pays to look at a few options before committing to a mortgage provider.

Choosing the right loan structure can help you reach your investment goals faster and save thousands of dollars in interest. Look out for features such as an offset account, the ability to make additional repayments, cash incentives, and reduced fees.

Shopping around for the best property loan deal can seem daunting, but it does not need to be. At Property Market Investor you can get a free home loan report online in 3 easy steps, which includes a Stamp Duty costs calculation and a suburb profile report.

You will also receive a free mortgage expert consultation from one of our home loan partners to find the right property loan to suit your needs.

Plan for contingencies

Ensure that you are prepared to deal with financial setbacks. You will need to have sufficient funds to cover your investment property mortgage repayments in case the unexpected happens. For example, will you be able to service your property loan if your tenant gets behind on their rent or you lose your job?

Budget for the everyday costs

Consider the ongoing costs of being a property investor when putting together your budget. Ensure you have ongoing funds for expenses such as renovations, council rates, repairs, maintenance costs, and insurance.

Step 3: Source your deposit

As a rule of thumb, you should try to have at least a 20% deposit of the investment property purchase price. This way you can avoid lenders mortgage insurance (LMI) premiums on your loan. It will save you thousands of dollars if you ever default on your mortgage.

There are several ways to fund your investment property deposit:

Cash

The most obvious way to fund your investment property deposit is to come up with a cash deposit.

You can talk to a financial planner, set a budget for your living expenses, and get in the habit of saving regularly. Choose a high interest savings account to make your savings grow faster.

Use our Savings Calculator to find out how long it will take for you to save for your investment property deposit.

Equity

If you have owned your family home for some time, it is likely that you are sitting on some equity. Equity is calculated by taking the current market value of your property, minus the amount you owe. For example, if your home is valued at $600,000 and you still owe $200,000, you’ll have $400,000 of equity.

You can use the equity in your investment property home loan and start building your portfolio.

Family guarantor

This is when a family member allows you to use the equity on their property to secure an investment property loan. This can be a good solution If your parents or other close family members are willing to help you get started in the world of real estate investing.

Real estate investment trusts

Real estate investment trusts (REITs) can be a good way to get started as a property investor. Rather than investing in a single property, REITS are managed trusts that combine investors funds to invest in a diverse range of real estate assets. Risks are deemed as lower as they don’t rely on a single property to generate returns.

Self-managed super fund

Many Australians are choosing self-managed superannuation funds (SMSF) as a way to plan for their retirement. This type of fund allows investors to decide which assets they want to invest in.

In order to use your SMSF to buy investment property you will need to satisfy the following criteria:

- The SMSF property needs to be purchased with the sole intention of providing retirement benefits to the SMSF members. (a SMSF can have between one and four members)

- The SMSF property must not be bought from a related party of any of the SMSF members.

- the SMSF property cannot be used as the living quarters of any of the SMSF members or their relatives.

The SMSF property can’t be rented by any of the SMSF members or their relatives.

Super investment is a popular option as property investments in Australia have a track record of delivering healthy long-term investment returns.

If you don’t have a SMSF, your first step will be to seek professional advice to determine if this is the right fund for your retirement.

Co-borrowing

Pooling resources with family members or friends can be a good way to share the costs of buying and maintaining an investment property. You should bare in mind that you would be responsible if one of the borrowers defaults on their mortgage payments, so make sure you seek legal advice before going down this route.

Step 4: Choose the right investment property

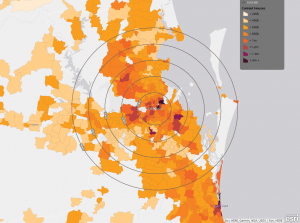

Location

The key factors property investors should look for are:

- Good schools

- Stable job market

- Good infrastructure such as shopping centres and public transport

- Desirable area

Big cities: these are a popular choice with property investors as they tend to have a higher population and good infrastructure, which results in higher rental demand.

Beyond the inner city: look out for regional areas that are showing strong growth in population and infrastructure.

As you grow your investment portfolio it is key to diversify. Having a good mix of properties located in well established cities, as well as up-and-coming regions will lower risks and can provide better returns in the long-term.

Choose low-maintenance properties

Property investors should look for properties that won’t require a lot of ongoing maintenance, as is often the case for older houses or properties with big gardens and/or swimming pools.

Buying off-plan

Tenants love new builds, so buying off the plans can be a sound investment. You generally only need a 10% deposit to buy off-plan, but it pays to be careful and check out the developer’s and builder’s track record and credentials before committing to a purchase.

Subscribe to Property Market Investor to receive off-the-plan opportunities tailored to you, including apartments & units, house & land packages, and townhouses

Think like a tenant

Consider they key housing requirements for potential tenants in your particular neighbourhood. Think about who wants to live in the area: Is it popular with young professionals, students or families? Things to consider include proximity to schools, off-street parking, public transport options and nearby amenities.

Don’t be influenced by emotions

Remember: you are not buying this property to live in it yourself, but to make money. Don’t let emotions influence your choice of investment property. You might be a villa lover, but is this the best investment choice?

Buying a display home

Buying display homes and leasing it back to the builder can be the perfect way to get started as a property investor. Benefits include a guaranteed rent return of 8% for the life of the display village, good tenants who will keep the place spotless, and a home that boasts the highest quality workmanship.

Making the most out of your investment property

Once you have purchased the perfect investment property, you will need to stay focused to avoid common mistakes and maximise returns.

Treat your property as a business

Remember that real estate investing is a long term journey. You will need to keep focused on the goals you want to achieve, and not lose sight of the big picture. Regularly review your investment’s fundamentals to make sure you optimise your portfolio.

Decide who’ll manage the property

Hiring the services of a property manager costs money, but can be a practical way to deal with the ongoing demands of an investment property. If you choose to manage the property yourself, you will need to be comfortable dealing with issues such as finding tenants, organising repairs and chasing payments.

Don’t neglect your property.

Do regular property checks to ensure your tenants are looking after your investment. You will also need to remember to schedule regular maintenance such as painting, cleaning the gutters, chimney sweeping and mowing the lawns.

Renovate but don’t overcapitalise

Put your property investor hat on as you plan your renovation project. Tenants look for nice kitchens and bathrooms, so it is a good idea to invest in these areas in order to maximise your rental income. Before embarking on a renovation, you should establish your budget and get professional advice. Talk to a valuer or real estate agent to find out how much value your renovations would add to your investment property.

Generally speaking, you should budget 10% of the property value for the renovation. So for example, if your rental property is worth $500,000, you should budget around $50,000 for the project.

Make the most out of tax incentives

Many of the costs related to investment property may be tax deductible. These include advertising, property management fees, mortgage interest, repair costs, and insurance. Property investors can also benefit from losses arising from negative gearing. This means that if the income from your investment is less than the expenses, you can claim a tax deduction from your loss.

Ready to take the first steps towards becoming a property investor? Get your free Home Loan Report now

Pingback: What is a Foundational Portfolio? - Property Market Investors

Pingback: What is a mortgage broker? - Property Market Investors