Monday 15th December 2025

Successful Property Investor Shares, How to Retire Within 18 months

Dymphna is an experienced real estate investor who retired her day job as an accountant after accumulating a multi-million-dollar property portfolio.

Born is a small central Queensland town, Dymphna is mother of 3 children and self confessed property obsessive. Unlike the majority of investors who simply get their kicks from the property porn sites such as Domain and Realestate.com.au, Dymphna put her plan into action and was able to build a $3.5 million property portfolio and replace her income as an accountant within just 18 months of getting started.

What are Dymphna’s top tips for retiring from property?

- Buy positively geared property

- Avoid negative gearing as a strategy, even if your accountant suggests it

- Make sure you purchase in the correct structure

- Learn how to create equity to recycle your deposit

Interested in learning more about Dymphna’s strategy through her best-selling book? Follow these quick steps:

Step 1: Select your age range from the below options

Step 2: Complete your simple investor profile questions

Today, Dymphna lives on 32 acres on the beautiful Sunshine Coast surrounded by the rainforest. She practices yoga every morning amongst the native birds and trees. Alongside this she gets to spend her time helping other people move towards this kind of life, just like her mentors helped her when she got started in property.

So what’s Dymphna’s outlook for the property market over the next 1-2 years, despite the Coronavirus outbreak?

Dymphna says that it’s important to keep things in perspective when trying to evaluate potential impacts. There have been much bigger threats to the Australian Real Estate market over the last 25 years, and the reality is that the Corona Virus will not impact the fundamentals of the Australian property market.

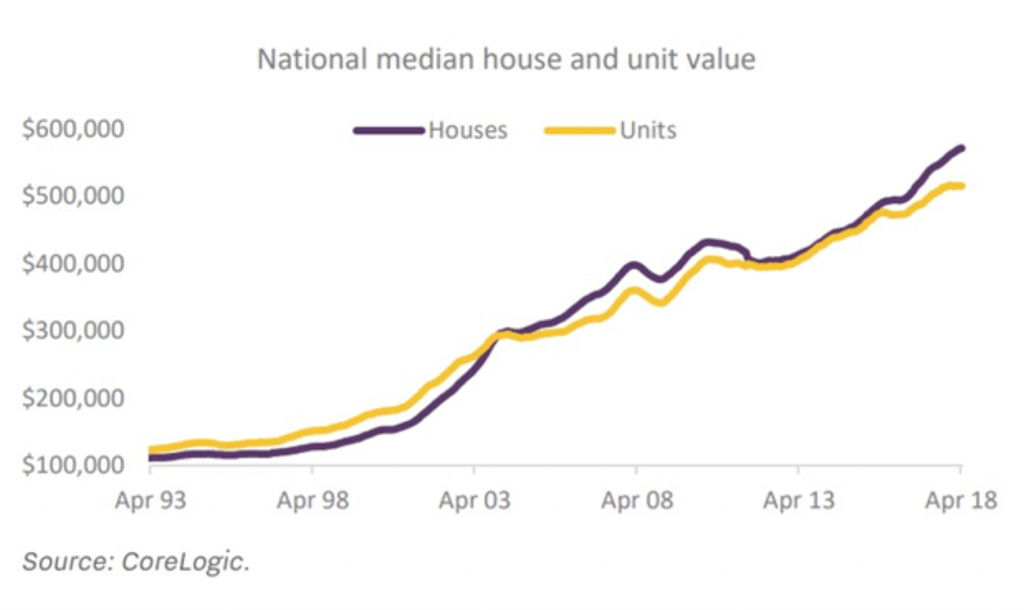

For example, looking back people that purchased a property 26 years ago have across the board made significant gains. The below national median house and unit value from leading property data house – Corelogic shows that if a house was purchased for around $100k in 1993, its value on average in 2018 had increased to over $550k, which is a 550% increase in value and a $450k profit.

Now imagine if you had a strategy and foresight to purchase 10 properties in 1993, what would your life look like now?

Want to know if you can do something similar?

Step 1: Select your State below

Step 2: Gain access to Dymphna’s best-selling book ‘Confessions of a real estate millionaire’