Thursday 18th December 2025

Groud-breaking new way to use Super to purchase a property to live in.

Up until now first home buyers, or prospective property investors have been required to complete the increasingly challenging requirement of saving for a property deposit before the can enter the property market. Despite a recent fall in property values within the Sydney and Melbourne markets, it is the common opinion that the current median values are still too high.

In recent times it’s true that new property buyers have seen the property ownership dream slip out of their hands with some markets growing each year at a rate which is higher than their ability to save the required amount for a deposit.

To get on the property ladder you need to have the ability to reach the first step, however what has been evident in recent years is that that this first step has been growing higher and higher to reach.

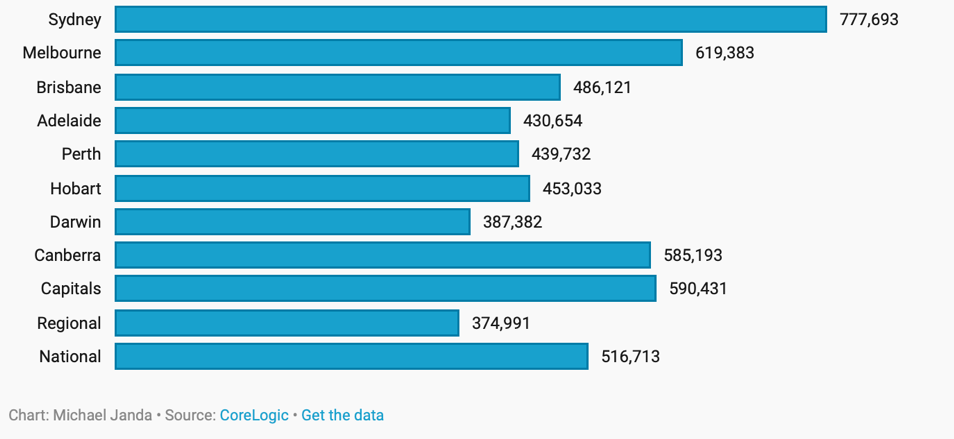

Median Property Price by City

So how does Superannuation come into play?

Whilst it is commonly known that people can purchase an investment property through the creation of a SMSF, it has until now not been brought to people’s attention that as an alternative to this there is a way in which people can personally access their superannuation to purchase property in their personal names for either owner-occupier or investment purposes.

Interested in learning if you qualify to access your super funds to buy property?

Step 1: Select your age range from the below options

Step 2: Complete your simple investor profile questions

What are the limitations of purchasing an investment property through the traditional SMSF means?

- A 30% or higher deposit amount is required — often $200K+ including cash a buffer

- Fewer lenders are now offering SMSF loans, meaning that lending

is getting more difficult - Unable to access the benefits until retirement, which might not be until you’re 65, or even 70 years of age

- Cannot use the property for personal means, or to the benefit of a

family member - Once purchased, you’re unable to add value to the property through renovations, developments, or sub-division

So how can you now use your Super funds to use as a deposit to purchase a property personally?

Imagine buying a $500,000 apartment:

- A husband and wife have $62,500 each in super = $125,000. This

puts them in the perfect position to create a self-managed super fund (SMSF) in order to buy property and set themselves up for the future. - $125,000 is placed into a SMSF, $75,000 is used for a deposit and the remaining $50,000 stays in the SMSF bank account to earn interest or can be used to trade share or other investment strategies.

- The $75,000 makes up 15% of the deposit, so all the husband and wife need to do is contribute a 5% deposit of $25,000. They can do this using personal savings or a personal loan.

- Their total deposit is $100,000, or 20% of the $500,000 purchase price.

- A portion of super, representing the deposit of $75,000, is invested in a shared equity managed fund. The fund releases an equivalent amount of money to a property they nominate, to purchase in their own name.

- The unique benefit is the property is owned in their name, not the SMSF, so they will enjoy any tax benefits personally. And they are on their wealth creation journey.

- The likely growth in equity during this period could allow them to purchase further properties, in their own name too.

Want to know if you can do something similar?

Step 1: Select your State below

Step 2: After answering a few questions we will partner you with an expert property investment advisor most suited to your needs